For all the benefits it offers, retrofitting is still the poor cousin of actions that cut emissions. There seems to be just too little of the interest and energy efficiency financing needed to meet our goals for a more sustainable built environment. But not in California. Former Young Leader Kelly Delaney works on a programme that facilitates funding via an innovative public-private partnership. Here, she tells us how the state used this to cause a surge in retrofitting.

Did you know that the built environment produces around 40% of the harmful greenhouse gasses that threaten the stability of our ecosystems and civilisation? If nothing is done about it, that figure will double in 30 years.

Retrofitting gives us a chance to turn properties that produce more than their fair share of energy into ultra-efficient, snug, healthy, and cheaper-to-run boxes of happiness.

Uptake is slow, however. That’s why we need people like Kelly Delaney.

Spotlight on California

Kelly works on the GoGreen Home financing programme. This is an initiative set up to make financing for energy efficiency retrofits and upgrades more accessible. It’s run by the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA), a department in the California State Treasury.

“My programme facilitates energy efficiency financing for the residential, commercial, and affordable multifamily sector,” Kelly tells us.

This is much needed. In 2019, the California Energy Commission reported that energy savings for gas and electricity combined were “about 20 percent short of the 2030 goal”.

Why Regulation?

After working for a company that developed regulatory software for local and state governments for a few years, Kelly found herself drawn to work like this, which serves the public good more directly.

Our CityChanger’s multifaceted role as an Energy Efficiency Financing Specialist is to support her programme’s strategic development and growth. A large part of that involves writing new regulations and shepherding them through the formalisation process. That is: get these regulations approved and implemented.

It’s a fairly democratic process, as well, utilising public engagement to ensure they and the regulated community has a chance to weigh in on each proposed rule change.

“Our regs are our guiding light,” Kelly tells us. “They set the standards for project eligibility, data collection, and quality assurance for our projects and loans to make sure they’re in compliance with our mission.”

Through this programme, Kelly also works with contractors to offer more than 60 eligible energy efficiency measures, or EEEMs.

EEEMs can be anything from building envelope renovations (like insulation, air sealing, and ductwork) to less-energy-intensive equipment (“air cooling and heating systems or water heaters”) and efficient lighting and appliances.

It makes more sense if we can do a comprehensive retrofit that includes multiple complementary measures.

Retrofitting Via Clever Financing: The Challenges

After six years, the programme recently moved out of the pilot stage.

It is still evolving, and Kelly – who has been on board for two of those years, focusing on the residential and multifamily programmes – is instrumental to shaping the different areas of design and implementation.

Addressing High Up-Front Costs

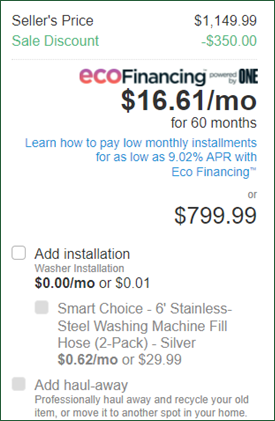

Carrying out home energy upgrades can be expensive: a new heat pump system can cost upwards of $18,000. Expensive technologies may improve efficiency, but high upfront costs put them out of reach for many residents. Breaking down this barrier is what makes financing such a powerful tool.

“Financing can help spread those costs over time, allowing customers to get the project they want today without compromising on scope or efficiency.”

Security for Lenders

Leveraging private capital for financing programmes, Kelly notes, breaks new ground.

To ensure that the funding gets to the right people, our CityChanger works with credit unions – a type of community-focused bank, sometimes called mutual societies – and other financial institutions to perform the underwriting and origination (in laypersons terms: assessing the risk and approving the loan).

Clean energy financing is still quite nascent, Kelly tells us.

Many private capital providers are hesitant to lend because of concerns about the risks and costs they perceive in energy efficiency projects. This trepidation is reflected in their restrictive requirements for underwriting.

“Many mainstream lenders are not accustomed to underwriting energy savings or using energy improvements as collateral. And they can be uncomfortable relying on home improvement contractors because of the potential for risk in their performance.”

Fully aware of the pressures of climate change, California knew something had to be done.

So, the state came up with a clever way to cushion the risk: a loan insurance fund.

Loss Reserve Structures

In the eyes of financiers, some people are at a greater likelihood of defaulting on loans, reducing their chances of being approved for borrowing.

This might be because, for example, they have a poor credit score or low household income, or because they live in a low-income neighborhood according to census data.

Kelly draws attention to the “tightrope of wanting to make financing available to more people, but also ensuring that we’re not saddling people with debt that they can’t pay back”.

That’s why the GoGreen Financing programme aims to, in part, help improve access to affordable loans for so-called “underserved borrowers” like these.

For each loan record that is submitted to the programme, CAEATFA – the Californian financing authority – contributes a percentage of its own funds to a “loan loss reserve” for the lender. This is equivalent to 11% of each standard loan, raising to 20% for underserved borrowers.

As the lender enrolls more eligible loans, the more the loss reserve grows.

For participating lenders, this really takes the sting out of the risk. They are assured a return of up to 90% on defaulted loans.

Fortunately, the loss reserve is rarely utilised.

“Of over 3,000 loans that our lenders have made, totaling about $49 million, only 80 have ended in a default.”

Proving that there is not only demand, but also reliable payback rates, “helps to develop the private capital-driven energy efficiency financing space,” Kelly observes. As a result, lenders feel confident in continuing to invest in this space.

Even better is that lenders have also shown a willingness to be flexible in the effort to make financing more attractive and available to those who need it.

“In exchange for us sharing the risk, lenders have to offer better terms for borrowers – longer payback periods, lower interest rates, larger loan amounts, and access for those with lower credit scores or income challenges who might otherwise struggle to access financing.”

And to sweeten the offer – and increase interest – borrowers can also use up to 30% of their loan for non-energy efficiency measures. For some, this may be the best chance they have for making their place feel more homely.

Innovative Public-Private Partnerships at Point-of-Sale

This programme is driving forward regulatory and programmatic change in a sector that is usually slow to move.

Having set up the loan-giving process, GoGreen Home partnered with a lender and an online marketplace operator to launch point-of-sale financing online. Offering loans at the digital checkout took accessibility to the next level!

This is the first state energy financing programme in the USA to be offered at point-of-sale and it’s taken off.

As people are already used to buying online, Kelly explains, purchasing financing at the checkout is a natural fit for many consumers.

Measuring Success

Whether California will close the gap on its 2030 targets remains to be seen but energy efficiency retrofitting is moving things in the right direction.

There is already evidence that change is in the air. GoGreen Home’s 2022 mid-year report highlighted “an average reduction of 445 pounds of CO2e per $10,000 of customer investment” in 2021. In the first six months of 2022, this increased by another 33%. These are impressive figures!

As for Kelly personally, she credits a natural curiosity as the launchpad for her creative problem-solving, and this led her to the field of energy efficiency finance.

“I really enjoy learning and am always wanting to see what else is possible and how others are approaching old problems in new ways.”

This is in part why our CityChanger signed on for the 2019 Young Leaders Programme in Oslo, Norway. We ask what she enjoyed about the experience.

“The networking aspect was really incredible. Especially for a young person at the start of a career shift, being able to connect with so many different types of people in different fields of urban and sustainability topics, that was really helpful.”

While doing so, Kelly discovered that peers in sustainability share her philosophy for embracing failure as a tool for learning.

We mostly hear about successes, and I think failure is actually where a lot of learning happens. I remember really appreciating that.

Then Kelly reminds us that innovations may not always go according to plan. Her advice for dealing with that? Don’t be put off. Regroup, rethink, and retry.

Networking with those sharing this mindset, Kelly recalls, gave her assurances that the move from the commercial to the public sector was right for her. It presented the opportunity to put her curiosity and problem-solving skills to excellent use with GoGreen Home. In doing so, she’s contributing to a template that other cities can learn from.

“What’s great about programmes like mine, and perhaps also relevant to other CityChangers, is that this model can be utilised effectively even by local governments. In the absence of a similar state or national effort, leveraging private capital can be a cost-effective way for municipalities to take a proactive approach to supporting energy efficiency in their communities.”